Australian Housing – Testing the Limits By Michael Fagan

Economists and property professionals are starting to question the sustainability of never ending Australian housing price rises.

Yarra Capital’s head of macroeconomic strategy, Tim Toohey, has just published a new piece, ‘The Looming Housing Excess‘ that raises questions about the current construction boom.

Oversupply of housing

Modelling by Toohey's team estimates that by the end of 2023, Australia will have 150k dwellings above demographic demand. Such an excess would be the largest since 2008. This forecast embeds a 30% decline in dwelling approvals as a base case by the end of 2022 and is therefore conservative.

A variable to the case presented by Toohey includes scenario analysis for a variation in net migration rates. If net migration doesn’t bounce back to 200k by 2023, the oversupply of housing will increase from 150k to 200k.

Toohey’s piece says that a significant oversupply of housing does not necessarily mean house prices are at risk of substantial decline. 2006 is an example where the predicted fall didn’t occur, but the RBA could cushion external pressures because monetary policy was on the tight end of the spectrum.

The RBA has highly accommodative monetary policy settings this time, and immigration is the main swing factor for absorbing supply. Add onto this a fiscal position highly reliant on Chinese largesse, and the likelihood of a soft landing seems less than an even-money bet.

Avoiding a bust

Toohey says, “The only way Australia avoids a significant excess of housing by 2023 is if approvals fall far more than anyone expects.”

Therefore he arrives at two conclusions:

· Firstly, Banks should consider building provisions against the risk of weaker prices rather than releasing provisions as seen over the past 12 months. The Bank’s average Loan to Value Ratios (LVRs) and bad debts are low by historical comparison, providing ample protection against any house price declines. Nevertheless, the boom in new borrowers for single homes on the periphery of the major cities are yet to build equity in their homes and are more vulnerable to any decline in house prices.

· Secondly, the only way to avoid an oversupply of housing is to stop building so many of them. The RBA continues to be bullish and currently forecasts dwelling investment declining just 0.5% in 2022 before rising again.

COVID-19 lockdowns remain a wild card. Prolonging lockdowns, especially in NSW is a huge drag on the economy and must eventually test the patience and bank managers of small business owners. Unemployment remains low, but staff under-utilisation rates remain above long term averages.

Louis Christopher, managing director of SQM Research, points out that property asking prices in Sydney have fallen for several weeks in a row. He also says there are signs banks’ lending criteria are tighter than last year, when they were happy to accept JobKeeper payments as a form of income.

“I would think if Sydney were to stay in lockdown through to December, it would be bad news for the local economy and that would feed through to the housing market,” said Christopher.

Economic signals flashing orange

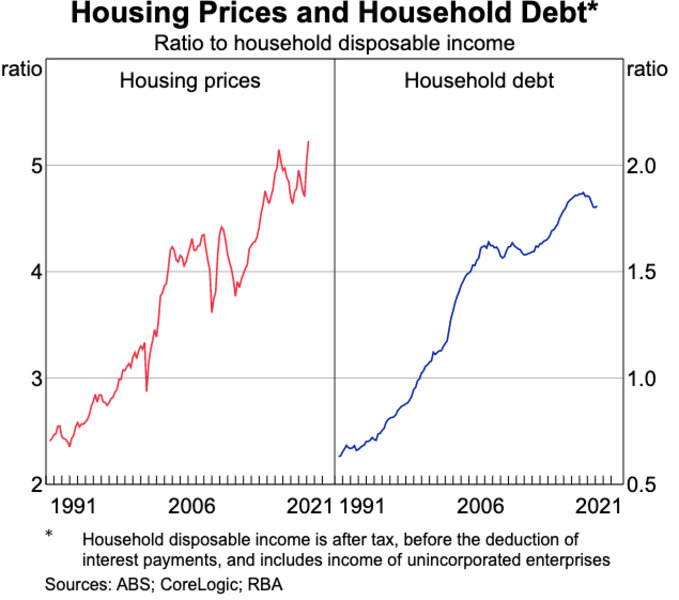

Other key warning signs are in the recently released Reserve Bank of Australia Chart Pack for the period ending 29 July 2021.

Of particular interest is the ratio of house price and household debt to disposable income. The chart shows that we have never been at these levels in both categories. They indicate a decline in overall affordability for those, usually under 35s, with little equity to support purchases.

Total housing loan commitments have also risen sharply, possibly because of the ‘fear of missing out’ on historically low financing rates.

The market is continuing to play chicken with the RBA, essentially saying that while the Board remains concerned about the fiscal side of the economy, they will vacillate about reigning in bond purchases, never mind raising the reference interest rate. For investors the game is the same; don’t be the last one off the ship when it springs a leak.

Being aware of what is happening in the market can save you thousands

Being up to date and aware of what is going on in the Australian property and the local economy is critical for your decision making whether you are selling, buying, swapping or want to rent a new property find it fast and easy at SSB.

At SSB there are no registration fees, no marketing costs, no listing fee's and zero lead charges. It’s 100% Free including for XML auto multi listings via your preferred CRM upload provider.

Buyers, investors and renters can be confident that every property listed with SSB has accurate details and the is price displayed upfront making sellers super competitive and, you get direct contact with the decision maker for viewings, negotiations and getting the deal done.

For owners, agents and developers listing their properties for Sale, Rent or Swap with Aussie free online service https://sellitswapitbuyit.com (SSB) they get global market reach and capture, brand exposure, enhanced income streams and prequalified searchers and direct connection at zero cost.