Australian real estate: Only 35 per cent of Aussies think now is a good time to buy property By Kirsten Craze

Buyers are taking a wait-and-see approach according to recent data that reveals only a third of house hunters feel now is the time to purchase property.

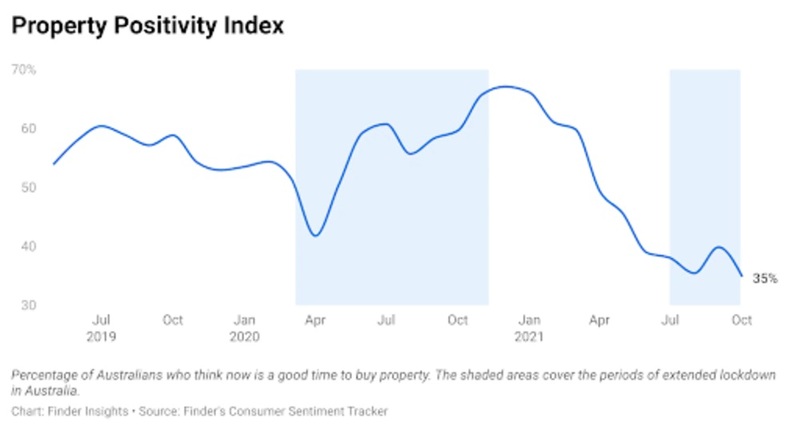

Just 35 per cent of Australians think it is a good time to buy, according to Finder’s Consumer Sentiment Tracker survey — the lowest level of property positivity since the comparison site began the monthly study two and a half years ago.

The report’s Property Positivity Index has continued a downward trend after hitting its peak in December 2020, when 67 per cent of respondents believed it was a great time to buy real estate.

That figure has now almost halved as affordability issues arise.

Graham Cooke, head of consumer research at Finder, said the seemingly unstoppable escalation of property prices was taking its toll on many frustrated house hunters.

“Extended lockdowns and border closures have done little to curb price growth this year. As we emerge from those lockdowns, a record number of Australians are pessimistic that now is the time to buy,” Mr Cooke added.

Since the pandemic, homebuyers have been through a roller coaster ride of sentiment.

“What’s interesting is that the property positivity index has been driven down twice in the last two years – but for two very different reasons,” he explained.

“We’ve been tracking this for nearly three years and in doing so we ask a lot of questions about people’s economic situation, including if they think now is a good time to buy property. The percentage of people who said ‘yes’ bounced between 55 and 60 per cent for most of 2019 and into 2020 – then it dropped pretty rapidly as soon as Covid hit,” he said.

Unsurprisingly, Mr Cooke said the positivity index dropped to 42 per cent by April 2020.

“Initially, the whole economy was in turmoil and people were afraid of what was going to happen to the housing and stock markets. The index number stayed relatively low and slowly came back to end up higher than it had been before the pandemic began,” he said.

“Australians actually had more confidence in the housing market after the initial lockdown than they had before Covid arrived.”

By October this year, however, Finder’s index is now lower than it was at the height of Covid confusion.

“This second fall is now happening for an entirely different reason. People don’t think it’s a good time to buy, but not because they’re afraid of what’s going to happen in the market this time. They just simply feel the market has become unaffordable,” Mr Cooke explained, adding that the correlation between soaring prices and plummeting positivity is clear on paper.

“The last 10 months of borrowing have been the highest 10 months on record, according to the ABS. And over that same period our index has declined and declined,” he said.

And the rising tide of prices looks set to continue, according to the panel of property experts and economists Finder interviews each month about its survey results.

“They seem to be fairly confident that prices are going to continue to increase, but maybe not as much in 2022 as they have done in 2021,” Mr Cooke said.

“Instead of the 15 to 20 per cent increases we’ve seen this year, we might be talking about a 5 to 10 per cent rise next year,” he said, which is promising news for first-home buyers struggling to keep pace with runaway prices.

“I think the bottom rung of the housing ladder is probably not going to increase away from people as quickly as it has been. The race to hit that deposit amount required will not necessarily be as fast as it has been. And that’s a good thing because it will reduce FOMO and also reduce the risk of people getting into the market when they’re not quite ready and not quite able to afford it,” he said.

Being aware of what is happening in the market can save you thousands for your new Home

Being up to date and aware of what is going on in the Australian property and the local economy is critical for your decision making whether you are selling, buying, swapping or want to rent a new property find it fast and easy at SSB.

Buyers, investors and renters can be confident that every property listed with SSB has accurate details and the asking is price clearly stated upfront making sellers super competitive and, you get direct contact with the decision maker for viewings, negotiations and getting the deal done.

For owners, agents and developers listing their properties for Sale, Rent or Swap with Aussie free online service SSB they get global market reach and capture, brand exposure, enhanced income streams and prequalified searchers and direct connection at zero cost.

At SSB there are no monthly or annual registration fees, no listing charges and no marketing costs, the average saving is $27,500. It’s 100% Free including for XML auto multi listings for agents.

SSB is NOT an agent, reseller or lead generator, we are an Australian owned and based free real estate service supporting the Australian property industry. Have a look https://sellitswapitbuyit.com.